401k Max Deferral 2025

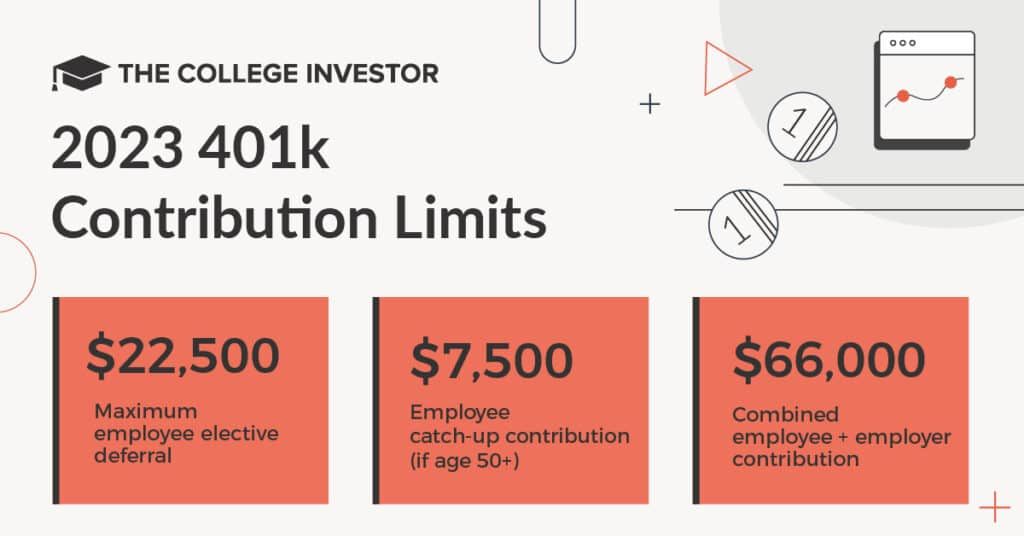

Blog401k Max Deferral 2025. Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000. Employees age 50 or older may contribute up to an additional $7,500.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, Discover why your 401k is. Contribution limits are set by the irs and refer to the amounts that can be contributed to a 401(k) each year.

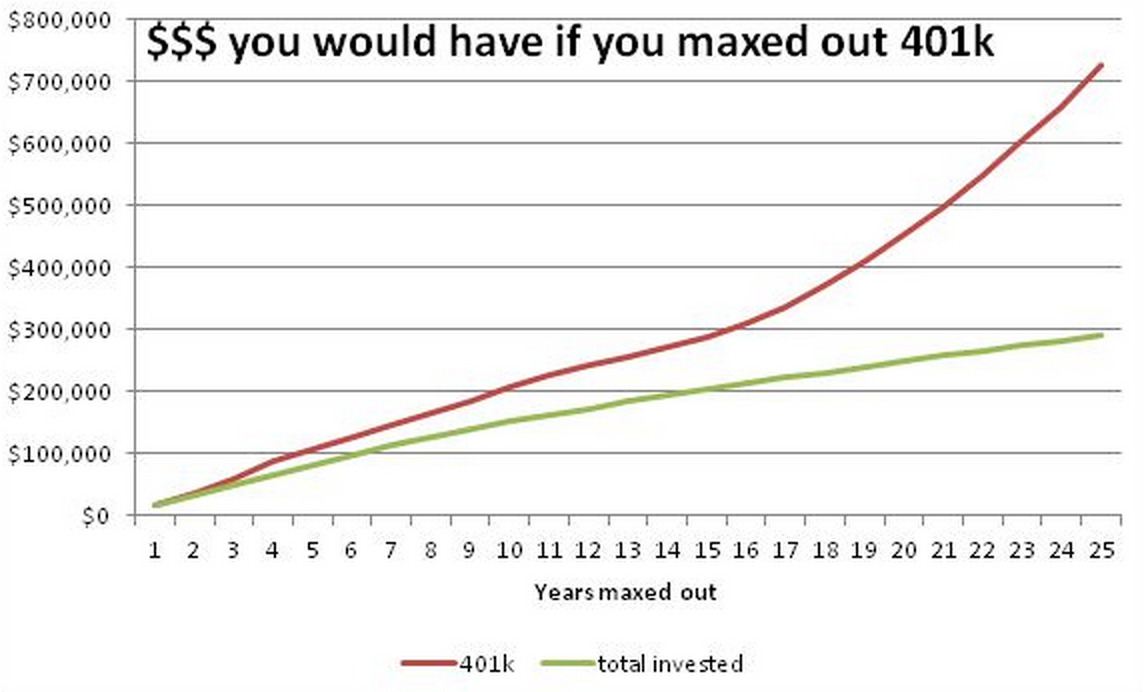

The Big List of 401k FAQs for 2025 Workest, 401k max contribution 2025 catch up. The problem is that it takes a lot of money to max out your 401(k).

401k Maximum Contribution Limit Finally Increases For 2019, In 2025, a 401(k) plan can elect to stop salary deferrals once a participant's compensation reaches $345,000 and can use only up to this amount when providing a. 401k max contribution 2025 catch up.

401k Calculator Calculators For All Mobile Friendly, Contribution limits for simple 401(k)s in 2025 is $16,000 (from. The annual elective deferral limit for 401(k) plan employee contributions is increased to $23,000 in 2025.

40 Passive Ideas For 2025 To Build Real Wealth Forex Systems, What is the 401(k) contribution limit in 2025? Discover why your 401k is.

Free 401(k) Calculator Google Sheets and Excel Template, In 2025, the 401(k) contribution limit if you're younger than 50 is $23,000. For 2025, the limit for 401 (k) plan contributions is $23,000, up from $22,500 last year, according to the irs.

Max 401k Contribution 2025 Include Employer Match Filia Klarrisa, For 2025, the limit for 401(k) plan contributions is $23,000, up from $22,500 last year, according to the irs. Max amount for 401k 2025.

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, The limit for a 401. $19,500 in 2025 and 2025 and $19,000 in 2019), plus $7,500 in 2025;

Plan Sponsor Update 2025 Retirement Plan Limits Midland States Bank, Some higher earners can funnel. 401k max contribution 2025 catch up.

401k And Roth Ira Contribution Limits 2025 Cammy Caressa, This is an increase of $500 from 2025. The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.